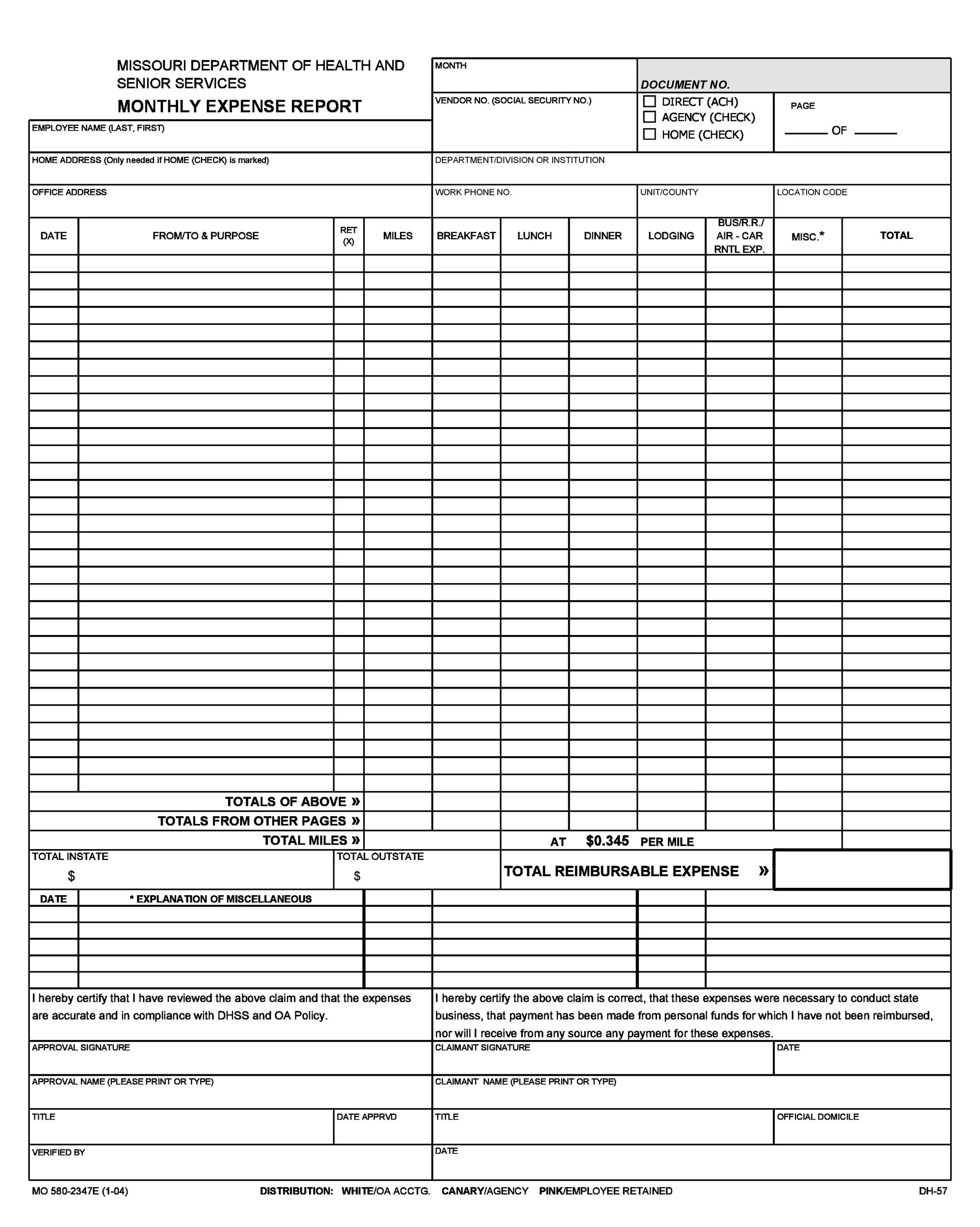

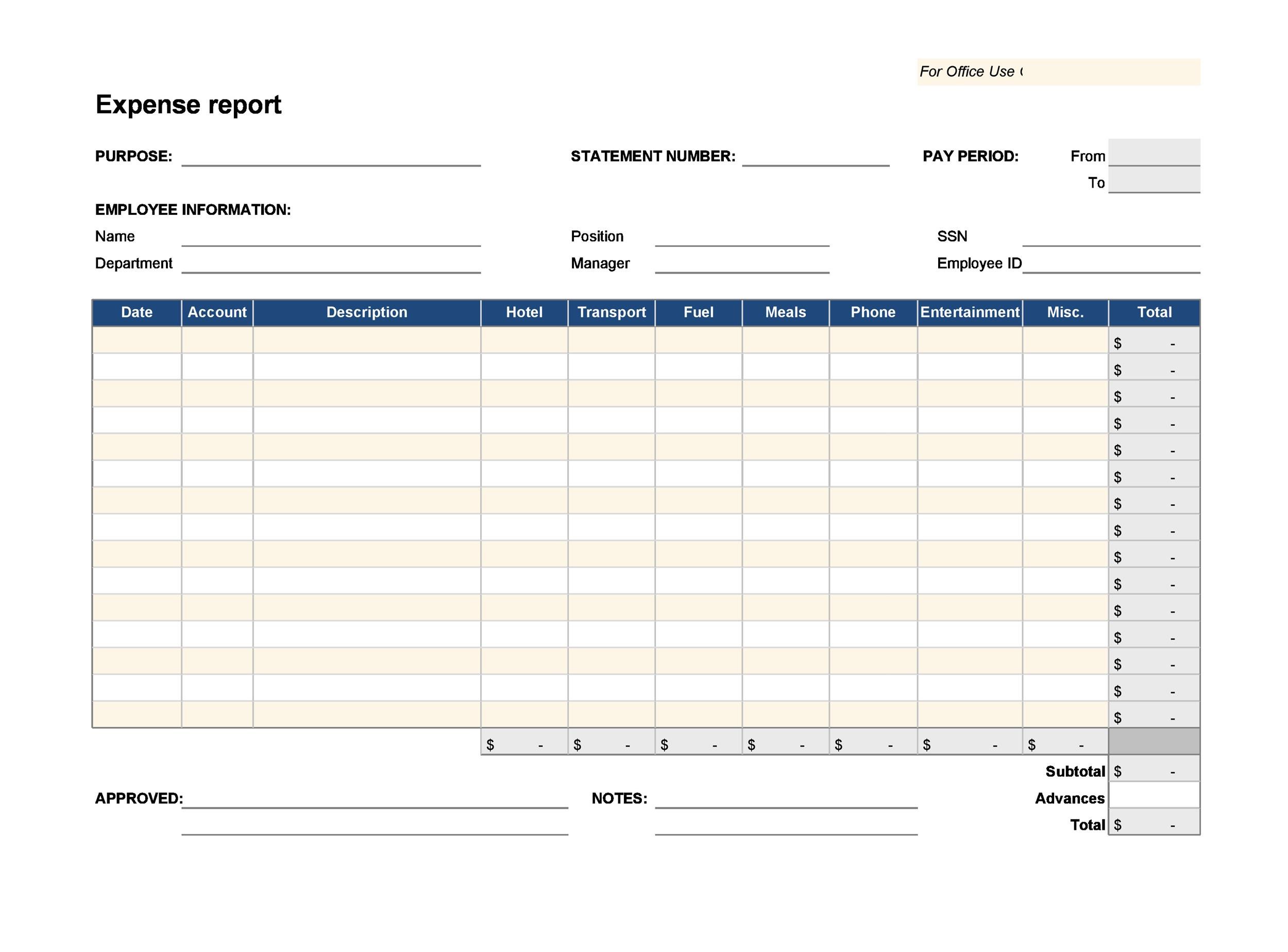

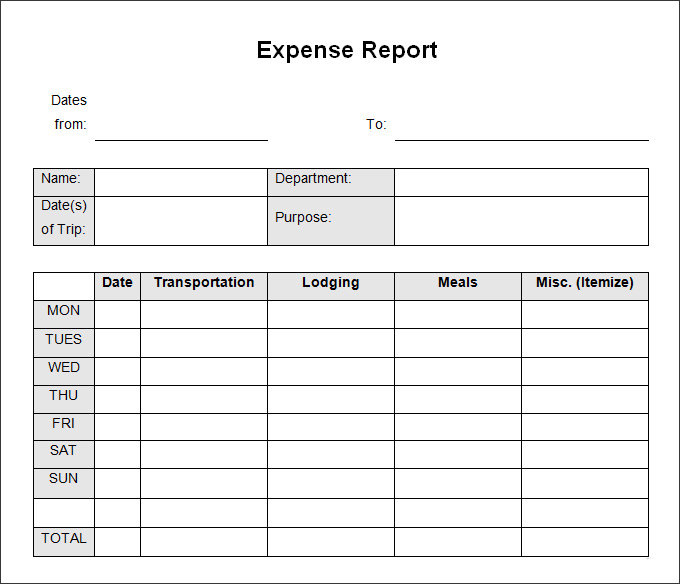

This report generates expenses according to tax category, like rent (we’ll cover this below). Amount: total cost of the expense, including taxīelow is a basic expense report example.Account: instead of client or project fields, an account number can be used.Project: what project was the item purchased for.Client: what client was the item purchased for.What Is Included in an Expense Report?Īn expense report typically has columns such as:

#Expense report software#

According to Entrepreneur, an expense report form includes any purchases necessary to run a business, such as parking, meals, gas, or hotels.Īn expense report can be prepared using accounting software or a template in Word, Excel, PDF, or other popular programs. Expense reports are crucial for helping track work-related expenditures.Īn expense report is a form that tracks business spending.Taxes are a large reason why small businesses need to use expense reports.In small businesses, expense reports are used when employees pay out-of-pocket for business expenses.An expense report is a form that tracks your business’s spending.Or a small business owner can use expense reports to track business spending and project spending and get organized for tax time. A small business may ask its employees to submit expense reports to reimburse them for business-related purchases such as gas or meals.

Send invoices, track time, manage payments, and more…from anywhere.Īn expense report is a form that itemizes expenses necessary for a business’s functioning and will help reimburse when an employee does incur business expenses. Pay your employees and keep accurate books with Payroll software integrationsįreshBooks integrates with over 100 partners to help you simplify your workflows

Set clear expectations with clients and organize your plans for each projectĬlient management made easy, with client info all in one place Organized and professional, helping you stand out and win new clients Track project status and collaborate with clients and team members Time-saving all-in-one bookkeeping that your business can count on Tax time and business health reports keep you informed and tax-time readyĪutomatically track your mileage and never miss a mileage deduction again Reports and tools to track money in and out, so you know where you standĮasily log expenses and receipts to ensure your books are always tax-time ready Quick and easy online, recurring, and invoice-free payment optionsĪutomated, to accurately track time and easily log billable hours

#Expense report professional#

Wow clients with professional invoices that take seconds to create

0 kommentar(er)

0 kommentar(er)